This guide will cover the changes that Banking & Finance DLC makes to the base Capitalism Lab game. I will also go through some of the options available when setting up a custom game.

What changes does the Banking & Finance DLC make to Capitalism Lab

For me, the most significant change that the Banking & Finance DLC makes to the Capitalism Lab game is the financing of companies, including your own. In the Capitalism lab base game, you can raise money by borrowing it, issuing bonds, or issuing new shares. In the banking & finance DLC, the mechanism is different. When you borrow the money, you will likely be borrowing it from a bank owned by one of your competing corporations. The bonds you issue can then be bought by competing corporations and insurance companies. Bonds are also graded by risk.

Suppose your corporation has money you can buy bonds that your competitors issued. If you still own the bond at the end of the loan period, you get paid the loan’s face value, and during its term, you will receive interest payments. You are also able to buy treasury bonds.

Banking & Finance DLC also allows you to purchase shares from the world stock market and shares with your competitors. Buy enough competitor shares, and you can still take over one of your competitors or wait for them to face bankruptcy in this DLC and get the option to take them over.

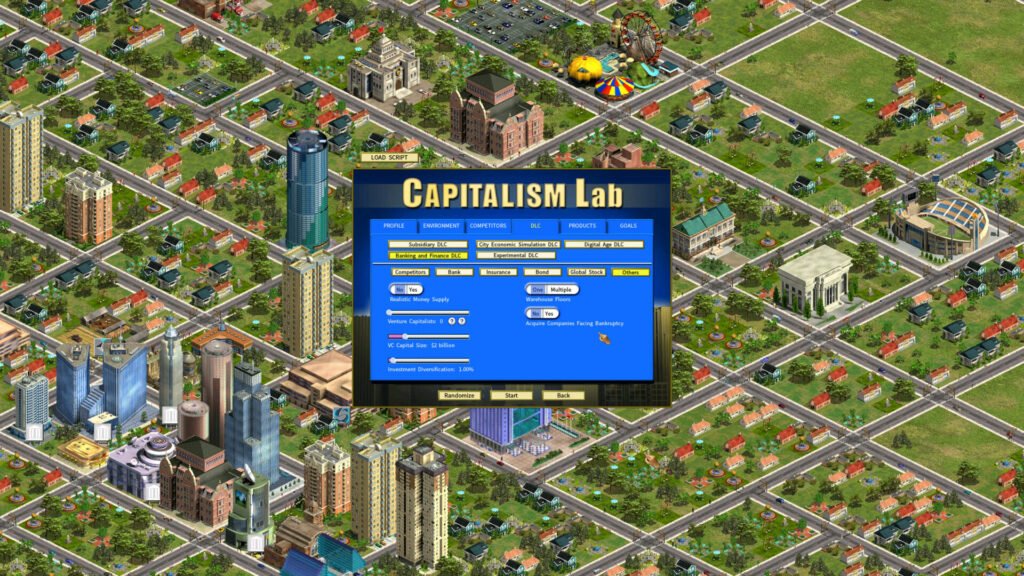

Capitalism Lab Banking & Finance DLC custom game setup

This section highlights some of the settings you can change for the Banking & Finance DLC. When you start a new custom game, includes the following.

- Agressiveness of banks and insurance companies. Sets how competitive AI controlled banking and insurance company interest rates or prices will be

- Realistic loans when swiched on. Will correlate loans with the total GDP for that city

- The bank capital ratio which is the ratio of the banks equity capital to its total assets. Set to low and the banks could face a run during an economic slowdown

- Personal savings rate modifier. The higher the rate the more money people will deposit in the game

- Initial interest spread. The difference between what a bank pays on deposits and the rate offered in loans

- A corporate deposit cap. Limits the amount each corp can deposit wihin a bank

- Economic impact of loans. Sets the number of people who will likely default during an economic slown down

- Insurance claims – sets the number of people who will make insurance claims

- Percentage of players capital funded by bonds. The amount of your initial company funded by bonds

- Bond credit standard. The setting impacts corporate credit ratings and therefore the cost of loans for corporation

- Bond issue limits. Sets the the maximum number of loans a corporation can issue

- Global stock market. If switched on allows you to purchase shares from the global market

- Realistic money. Makes money supply more realistic making it more difficult for corporations to raise money

- Venture capitalist. Specifies the number of venture capilists within the game

- Venture Capitalist size. The average size of capital for venture capitalist.

- Investment diversification. How diverse will the venture capitalist holdings be

- Acquire companies facing bankrupcy. If on you can buy companies facing bankrupcy.

As you can see, there are a large number of settings available to change and one random one I hadn’t suspected seeing while doing my research. A setting that allows you to turn on or off multiple floors for your warehouse.

Conclusion

I hope you found this overview of the Banking & Finance DLC helpful.

You may well be interested in our guide to running a bank in Capitalism Lab.